Build and ship production-grade crypto algos, fast.

Design and deploy fully-automated, permissionless trading

strategies on Web3 in minutes. No coding required.

Design and deploy fully-automated, permissionless trading strategies on Web3 in minutes. No coding required.

Design and deploy fully-automated, permissionless trading

strategies on Web3 in minutes. No coding required.

Execute on proven venues

Execute on proven venues

Strategies receive trading-only permissions on the venue you choose. Funds never leave your vault. Go live on Drift today, with Hyperliquid, Jupiter, and pump.fun next.

Strategies receive trading-only permissions on the venue you choose. Funds never leave your vault. Go live on Drift today, with Hyperliquid, Jupiter, and pump.fun next.

Drift

Hyperliquid

Jupiter

Pump.fun

Readable Strategies,

Predictable Outcomes

Strategies conform to an opinionated structure that maximizes clarity and guarantees deterministic execution.

Strategies conform to an opinionated structure that maximizes clarity and guarantees deterministic execution.

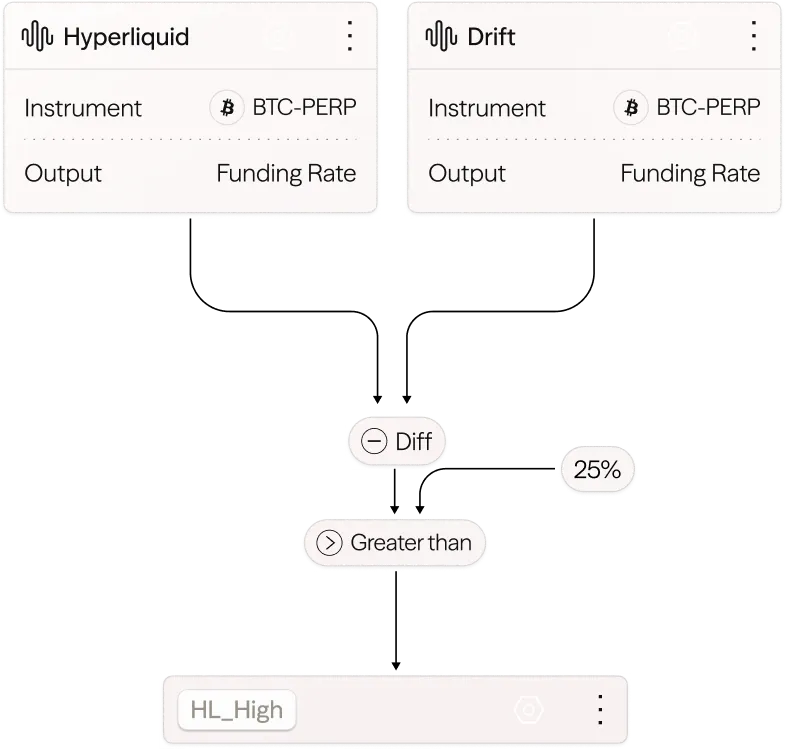

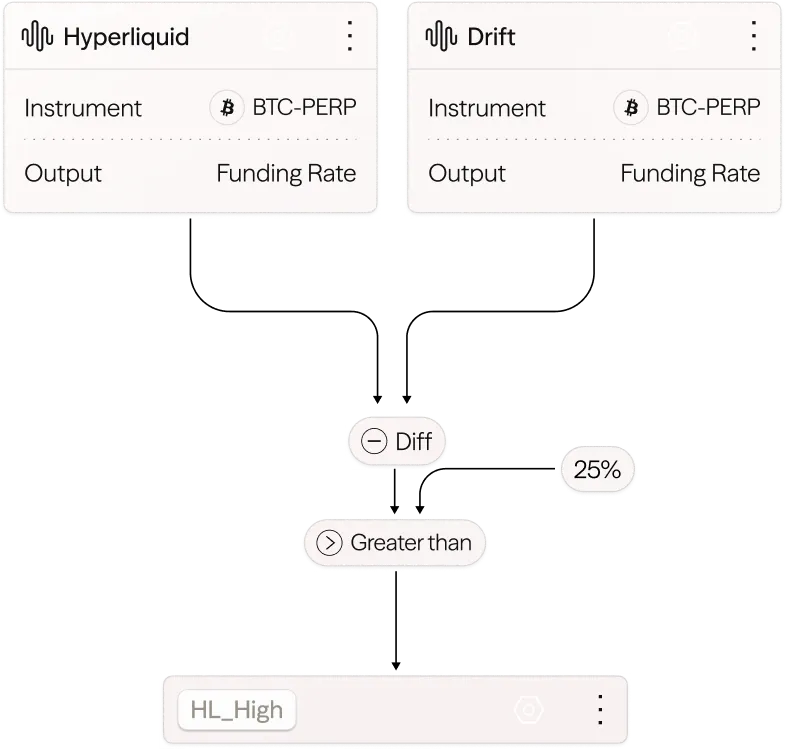

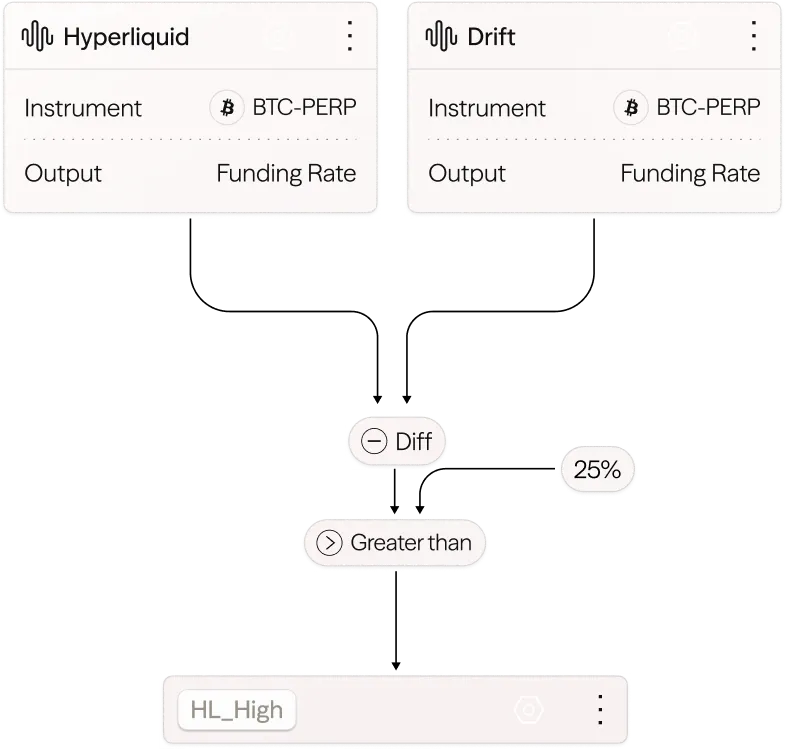

I'd like a delta-neutral strategy aimed at Bitcoin

Here's the classic funding rate arb parameterized with a minimum net funding rate delta to make sure you aren't overtrading and losing due to trading fees.

I'd like a delta-neutral strategy aimed at Bitcoin

Here's the classic funding rate arb parameterized with a minimum net funding rate delta to make sure you aren't overtrading and losing due to trading fees.

I'd like a delta-neutral strategy aimed at Bitcoin

Here's the classic funding rate arb parameterized with a minimum net funding rate delta to make sure you aren't overtrading and losing due to trading fees.

Autonomous Trading. Purely Permissionless.

Autonomous Trading.

Purely Permissionless.

Autonomous Trading.

Purely Permissionless.

Instantly adapt and execute automated strategies while your assets remain safely non-custodial.

Instantly adapt and execute automated strategies while your assets remain safely non-custodial.

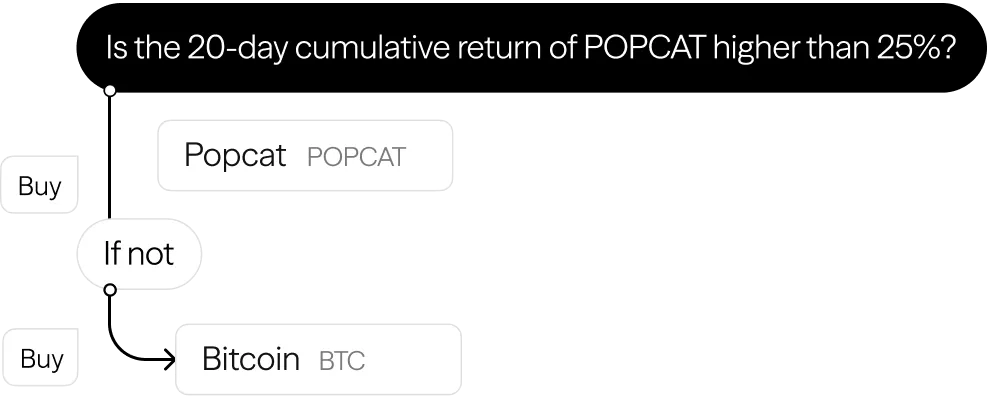

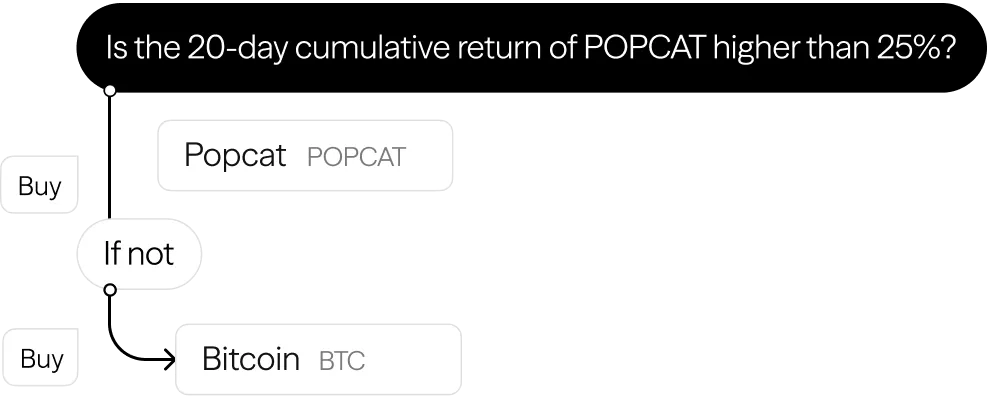

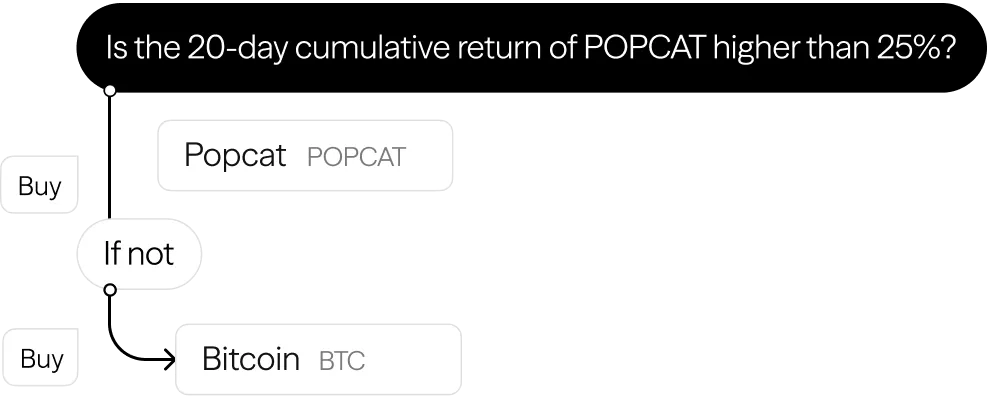

A portfolio that reacts to the market

Signal values determine strategy state and state transitions with simple if/else control flow.

Signal values determine strategy state and state transitions with simple if/else control flow.

Permissionless by Design

Wallet Authentication. Strategies get trading only permissions; No accounts. No emails. No KYC.

Wallet Authentication. Strategies get trading only permissions; No accounts. No emails. No KYC.

More Automation

Structure executes your trading strategy, making trades and rebalancing automatically.

Structure executes your trading strategy, making trades and rebalancing automatically.

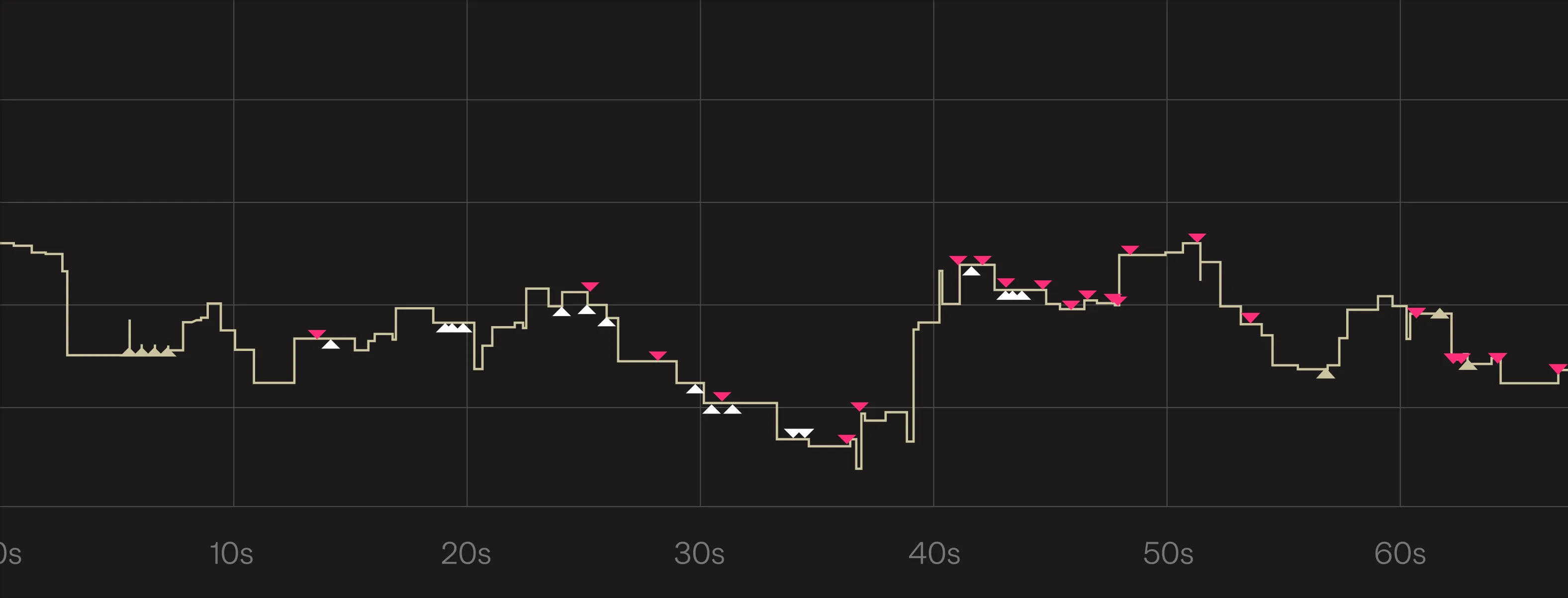

Tick-Level Data Driving

Real-Time Trading Decisions

Tick-Level Data Driving

Real-Time Trading Decisions

Signal values are computed from tick-level market data yielding strategy state transitions that are indicated by simple if/else control flow.

Signal values are computed from tick-level market data yielding strategy state transitions that are indicated by simple if/else control flow.

Signal values are computed from tick-level market data yielding strategy state transitions that are indicated by simple if/else control flow.

An anatomy that maximizes clarity

enabling easy reasoning.

An anatomy that maximizes clarity enabling easy reasoning.

Data, Computations, & Signals

Turn tick-level market data into deterministic signals; every value is reproducible and auditable.

State Machine

Signal values determine strategy state and state transitions with simple if/else control flow.

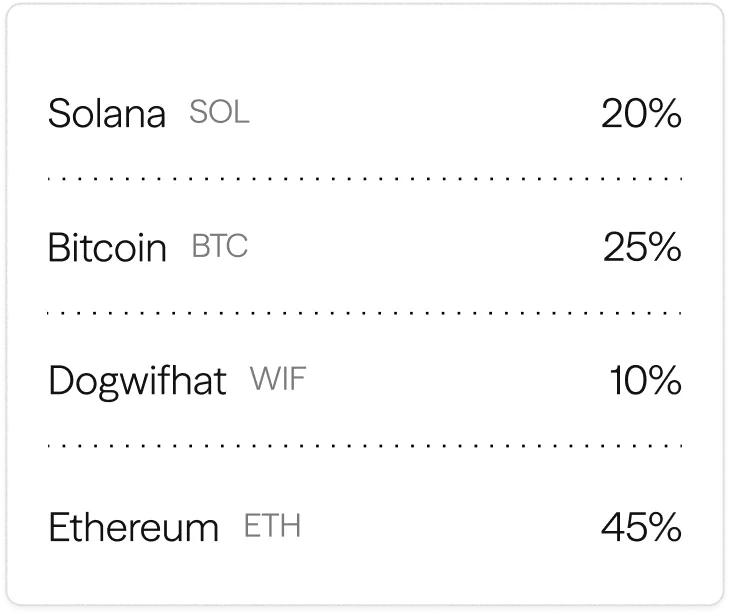

Target Positions

Each state resolves to one set of target positions. An executor manages orders to achieve those target positions outside of the strategy logic.

Data, Computations, & Signals

Turn tick-level market data into deterministic signals; every value is reproducible and auditable.

State Machine

Signal values determine strategy state and state transitions with simple if/else control flow.

Target Positions

Each state resolves to one set of target positions. An executor manages orders to achieve those target positions outside of the strategy logic.

Data, Computations, & Signals

Turn tick-level market data into deterministic signals; every value is reproducible and auditable.

State Machine

Signal values determine strategy state and state transitions with simple if/else control flow.

Target Positions

Each state resolves to one set of target positions. An executor manages orders to achieve those target positions outside of the strategy logic.

Learn & Adapt

Learn & Adapt

Backtest on Structure, side-by-side with benchmarks or other strategies. Fees, slippage, and final value are calculated for you.

Backtest on Structure, side-by-side with benchmarks or other strategies. Fees, slippage, and final value are calculated for you.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

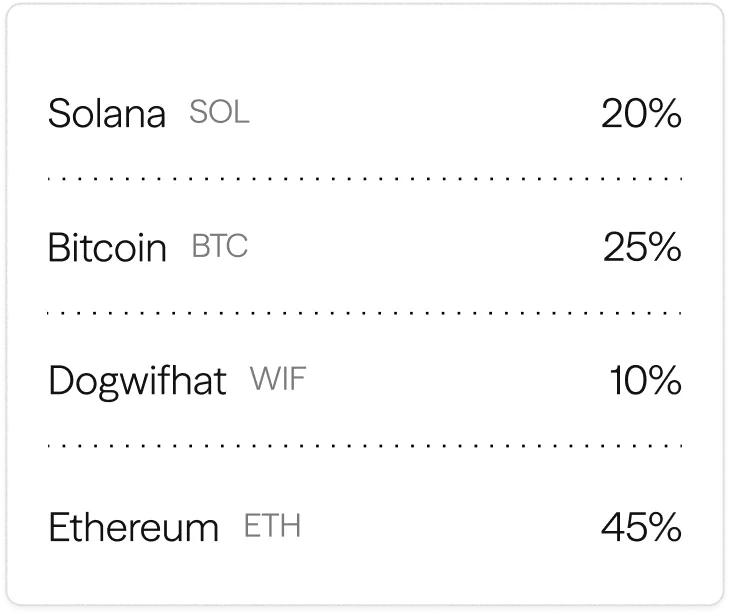

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Algorithmic Trader

Describe your idea in plain English and Structure generates, backtests on tick‑level data, and deploys deterministic on‑chain strategies you can audit end‑to‑end.

Prop Desk Quant

Run parameter sweeps and large backtest grids, then promote reviewed strategies to live with versioned, predictable lifecycles and transparent performance.

Liquid Fund Manager

Rebalance multi‑asset portfolios to risk/yield targets with AI‑built policies, efficient DEX execution, and wallet‑first, non‑custodial control.

Market Maker

Configure quotes, spreads, and inventory limits, then backtest and deploy to order‑book DEXs like Drift with guardrails, real‑time telemetry, and vault‑based safety.

Signal‑Driven Trader

Convert social, whale, or sentiment feeds from Discord or X into systematic entries/exits with backtested reliability and strict risk controls.

Frequently Asked Questions

How does Structure’s AI turn a natural‑language idea into a live trading strategy?

+

Can I use MCP agents or code to build and test instead of the UI?

+

Which DEX venues and chains are supported at launch?

+

How are signals created from tick‑level data, and how do they drive state changes?

+

What’s the difference between data, computations, signals, states, and target positions?

+

How do backtests work and what metrics can I expect to see?

+

How are credits billed in USDC, and what actions consume them?

+

What safeguards prevent unauthorized withdrawals or trades?

+

How do I version, review, and roll back strategy changes?

+

Do you currently take any trading fees on top of what the exchange charges me?

+

Frequently Asked Questions

How does Structure’s AI turn a natural‑language idea into a live trading strategy?

+

Can I use MCP agents or code to build and test instead of the UI?

+

Which DEX venues and chains are supported at launch?

+

How are signals created from tick‑level data, and how do they drive state changes?

+

What’s the difference between data, computations, signals, states, and target positions?

+

How do backtests work and what metrics can I expect to see?

+

How are credits billed in USDC, and what actions consume them?

+

What safeguards prevent unauthorized withdrawals or trades?

+

How do I version, review, and roll back strategy changes?

+

Do you currently take any trading fees on top of what the exchange charges me?

+

Frequently Asked Questions

How does Structure’s AI turn a natural‑language idea into a live trading strategy?

+

Can I use MCP agents or code to build and test instead of the UI?

+

Which DEX venues and chains are supported at launch?

+

How are signals created from tick‑level data, and how do they drive state changes?

+

What’s the difference between data, computations, signals, states, and target positions?

+

How do backtests work and what metrics can I expect to see?

+

How are credits billed in USDC, and what actions consume them?

+

What safeguards prevent unauthorized withdrawals or trades?

+

How do I version, review, and roll back strategy changes?

+

Do you currently take any trading fees on top of what the exchange charges me?

+